Scam alert: Beware of recent text scam involving fake bank fraud alerts

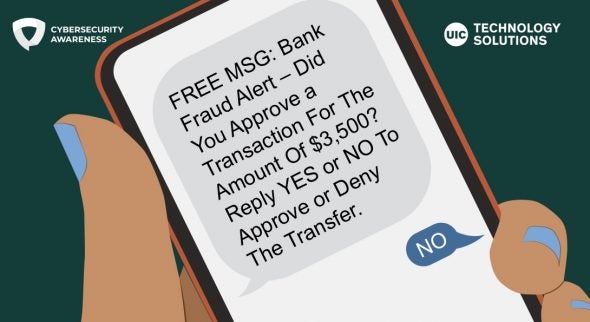

Scammers are sending text messages with phoney fraud alerts stating there has been a request to withdraw or transfer a large amount of money from your bank account. These texts may appear legitimate and contain the name of a bank you do business with.

- The Bait: Recipients receive a fraudulent text and are prompted to reply “YES” or “NO” to the text message to approve or deny a transaction. Once the recipient replies to the text, they will receive a call from the scammer posing as a bank representative.

- The Scam: The scammer will claim the transfer went through and to cancel the transfer, you have to transfer the money back yourself through a money transfer app, such as Zelle, to reverse the transaction. (Zelle is a popular money transfer app that enables users to send and receive money from friends, family and others they trust.)

- Consequences: Instead of sending the funds to your own account, as the scammer claims, you are ultimately transferring the funds to the scammer. Once you transfer the funds, the money is lost and is very difficult to retrieve. Many times, the bank will deny claims filed stating they are not at fault.

Spot the Scam

This scam has been reported with Bank of America and JP Morgan Chase customers but individuals should stay alert and learn how to spot a bank text scam:

- Banks will never use money transfer service to stop fraud.

This should be an immediate red flag. Banks will never call and ask you to stop a fraud by using a money app, such as Zelle or Venmo, or any other bank transfer service. If you get a call like this, hang up immediately. - Scammers can spoof legitimate phone numbers.

Scammers can replicate legitimate phone numbers and impersonate a business, which can fool victims into falling for the scam. Your caller ID may even display the business name. If you receive a call, hang up and call the bank directly using the number on your debit card or bank statement. - Scammers will use aggressive and urgent language.

Scammers will prey on your fears and claim you must transfer the funds before it’s “too late.” They will use aggressive language to scare you into acting quickly. Be sure to remain calm, ask questions and never be rushed into anything. If you receive a call like this, hang up and call your bank directly. - Never share sensitive or personal information with unidentified individuals.

Scammers will attempt to convince individuals to provide their personal information, birth dates, PINs, Social Security and any other sensitive information over the phone. You should never provide confidential account information to unidentified individuals or to unsolicited callers.

If you suspect you’ve been a victim of fraud, be sure to file a police report and submit it to your bank as part of the investigation.

Categories