Business center sees the futures (and derivatives)

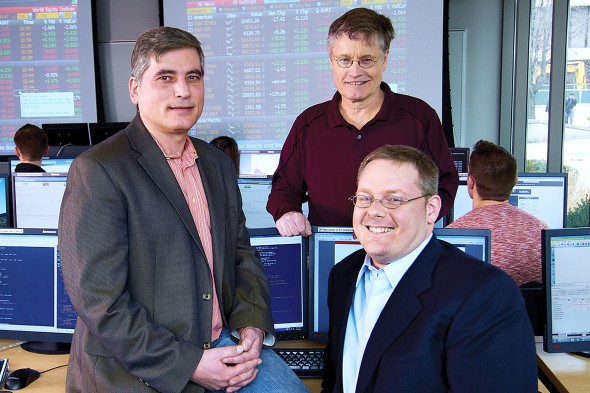

The brain trust of UIC’s International Center for Futures and Derivatives (left to right): John Miller, clinical

assistant professor of finance; Gilbert Bassett, professor emeritus of finance; and Dale Rosenthal, assistant professor of finance. Photo: Jeff Dahlgren

By Paul Engleman — UIC Alumni magazine

From his office on the 24th floor of University Hall, Gilbert Bassett has a breathtaking view of downtown Chicago. More importantly, he can see the futures. And the derivatives.

Bassett, founding director of UIC’s International Center for Futures and Derivatives, likes gazing upon the Loop headquarters of the Chicago Mercantile Exchange. The CME Group Foundation provided initial funding to launch the UIC center in 2007, then $1 million in 2011 to establish its centerpiece: the CME Foundation Market Training Lab in Douglas Hall. The lab, a research center for faculty, prepares students for the rapidly evolving world of commodities and futures.

“Trading today is a different animal than 20 years ago,” says Bassett, professor emeritus of finance who joined UIC in 1973. “It requires a completely different skill set.”

Exchange floor reinvented

Not long ago, trading involved “open outcry.” Traders down on the exchange floors shouted orders to buy and sell while waving their arms and motioning with their hands. To the uninitiated, the practice resembled controlled chaos. Today’s system is every bit as esoteric, but it relies on sophisticated high-speed software and instant access to real-time information from enormous volumes of data.

Negotiating new systems and protocols is what the International Center for Futures and Derivatives and its lab are all about. The lab harnesses software and proprietary real-world data from Bloomberg Terminal, Tick Data and others to simulate a variety of real-world trading scenarios. Software program Xtrader, for instance, allows students to simulate trading in futures markets, and monitor profits and losses.

“We’re taking the math off the blackboard so that students not only have an understanding of theory, but how theory works in practice,” says John Miller, clinical assistant professor of finance who commandeers the complex process of constructing and customizing the lab’s digital infrastructure — a task that requires uploading state-of-the-art software and inputting large volumes of critical historical data.

“We’re populating the lab at the micro level,” he says. “In addition to trades and quotes coming directly off stock exchanges, we have a rich array of data from Bloomberg on collateralized mortgage obligations, futures contracts, all types of currencies — the type of data you really can’t access anywhere else.”

Miller and colleagues have begun adapting their curricula to fully leverage the lab’s data and capabilities. Four lab-oriented courses were introduced for the fall 2014 semester.

For Miller’s classes in Fixed Income and Futures and Derivatives, students use the lab to learn both the mechanics and application of financial practices. The former involves replication of analytics from Bloomberg “as a first step toward building a financial calculator” and the latter, “a series of Q&As pertaining to how the analytics work,” he explains. “Financial markets need professionals who not only understand theory, but are capable of performing analysis.”

With 30 workstations, each with a computer terminal and two monitors, Miller says students can apply what they’re learning in an environment that simulates the trading room at a big investment firm.

“John is a ‘been-there, done-that,’” says Bassett, explaining that Miller enjoyed success on Wall Street and with Citadel, a Chicago-based hedge fund, before joining UIC. “Most ‘been-there, done-thats’ still work downtown. We’re lucky to have him.”

Academics based in reality

Both graduate and undergraduate students began using the lab for research projects last year.

“What’s interesting is how much they’re already using it to evaluate data independently,” says Dale Rosenthal, assistant professor of finance and another “been-there, done-that” who spent five years at a hedge fund and another three at an investment firm. “It’s blossoming right now, and it’s just going to get better.”

“The center provides us with a whole ecosystem — servers, data, software — the same tools and analysis packages you’d find at a trading firm,” he says.

The lab’s data system is supported by 20 terabytes of storage capacity and open-source R software, used for statistical computation and graphics.

“Open-source is of huge benefit because it allows students to instantly download those programs,” Miller explains. “Statistical R, for example, will allow them to manipulate data, create statistical models, perform estimates and plot results.”

Although students who use this program and others like it won’t necessarily pursue careers in finance, “the value is they’ll understand risk management and pricing of assets,” Miller says. Futures and derivatives, he notes, play significant roles in fields ranging from agriculture to pharmaceuticals to energy.

International player

The lab supports the center’s broader mission as “a global source for scholarship, collaboration, quality education, and cutting-edge, innovative research on futures, derivatives and financial markets,” Bassett says.

The center sponsors the International Symposium on Financial Engineering and Risk Management, an annual conference in China, with UIC’s U.S./Asian Executive Development Program, which has graduated thousands of MBA students from mainland China. “We may be better known in Shanghai than we are in Palatine,” Bassett says.

The center launched R/Finance in 2009. The two-day event on campus focuses on Statistical R, the premier, open-source software system for statistical computation and graphics, used to manage financial risk and construct portfolios. Besides attracting high-profile sponsors such as Google, Lemnica and Revolution Analytics, R/Finance has become an international event that draws some 300 researchers from business and academia.

Kassie Davis, executive director of the CME Group Foundation, says the organization views its financial support of UIC not as a donation, but as an investment.

“We see education as the engine of economic development,” she says. “Our mission is to enhance economic opportunity by supporting academic initiatives and activities that promote research, teaching and learning in financial markets, futures and derivatives.

“UIC is a trusted, long-term grant partner, one with whom we invest to achieve our mutual goals. It also is an important institution that enables many low-income students to achieve college success. We look forward to continuing our support of the university.”

To Bassett, that means a bright future in futures, and another reason to sit back and enjoy the view.