Neediest students most likely to miss aid deadlines

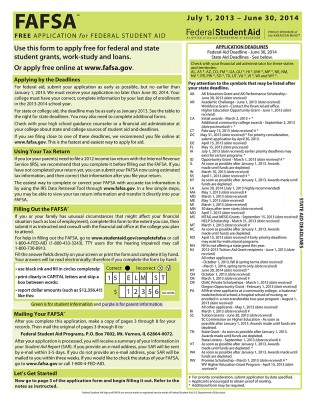

The Free Application for Federal Student Aid poses more than 100 questions in 10 pages. (Click on image for larger file.)

Students with the greatest need for financial aid for college are the least prepared to submit the applications early enough to receive it, according to a study by a researcher at the University of Illinois at Chicago and an Illinois financial aid official.

“Among all low-income students who qualify for need-based aid, those with a slightly higher expected family contribution are more likely to complete the application in time, as are those who had at least one parent who attended college, and who had better grades in high school,” said Mary Feeney, UIC associate professor of public administration.

Feeney conducted the study, published in the Journal of Student Financial Aid, with John Heroff, outreach policy specialist at the Illinois Student Assistance Commission. They analyzed economic, social and academic data on a random sample of 4,000 among 169,000 aspiring freshman students who qualified for the Illinois Monetary Award Program, which allocates need-based aid on a first-come, first-served basis; and who completed the Free Application for Federal Student Aid, or FAFSA, which is used not only for federal aid but also by states and colleges in making grants.

In FY2012, 158,349 Illinois students received MAP funding, which can be used for tuition and fees at any of about 140 public and private colleges in the state.

“Completing the application requires a considerable amount of effort and social capital — personal networks that students can draw on to gain information,” Feeney said.

“Students who have access to an adult who understands the process — a relative, guidance counselor, clergy member, or someone at a neighborhood association — are significantly more likely to complete the form and attend college.”

The researchers cite barriers that face low-income students and their parents in applying for aid:

- Confusing forms that ask too many questions, much like a tax return. More than 90 percent of low-income students who are allowed to skip most questions complete them anyway, suggesting that they are confused.

- Questions about family financial status that students may be unable to answer if their parents are absent or do not assist them.

- The assumption that parents will help cover college costs. Students whose parents will not contribute must prove their financial independence to each college, limiting their ability to apply to multiple colleges.

- Students’ and parents’ general lack of knowledge about available support. Low-income and minority parents are the most likely to overestimate college costs, and to consider a lack of financial aid information “part of a plan to keep their children from attending college,” the researchers write.

- Deceptive and proliferating deadlines. Many states and colleges impose deadlines months before that imposed by the U.S. Department of Education. Some states make grants until funds are depleted, so the deadline may change from year to year.

Feeney said help from organizations like the Illinois Student Assistance Commission, which offers information and workshops on completing the application, is critical.

“Eligible students with the most need should be targeted early for assistance to complete financial aid forms,” she said. “Financial aid administrators must understand that earlier deadlines disproportionately affect those students most in need of aid. States and colleges might consider earmarking assistance to students with the very lowest expected family contribution, or testing other mechanisms for equitably distributing limited aid to low-income students.